Glenn Beck warns: The East dumping of the petrodollar brings US economy closer to COLLAPSE

01/17/2023 / By Belle Carter

Eastern countries eschewing the petrodollar to buy Russian oil in their own respective currencies could bring the U.S. economy closer to collapse, warned conservative radio host Glenn Beck.

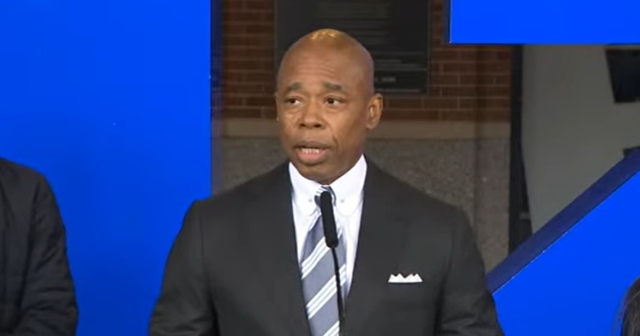

During a recent episode of “The Glenn Beck Report,” Beck pointed out that countries in the East such as China and Saudi Arabia are dumping the U.S. dollar for purchasing oil from Russia.

“Russian prices of oil are collapsing, making things better for Europe as they buy more Russian oil. But Saudi Arabia, China and Russia, they’re starting to move their entire economy. Russia is now backing their ruble with oil,” he said. Beck continued that half the world no longer needs the U.S. dollar, citing the example of Saudi Arabia accepting the Chinese yuan and the Russian ruble for oil purchases. (Related: BRICS member nations are creating new reserve currency to challenge the dollar, Andy Schectman tells Mike Adams.)

The conservative program host added that this causes too many dollars in the system chasing too few goods, subsequently pushing inflation further up.

“The [Federal Reserve] now is in a very unusual place,” Beck said. “Raising even another half point is spooking everybody. But when they do that, they take more money from you and slow your spending down, causing people not to chase goods with the dollar. “This will cause a stock market crash.”

Independent publisher Bankrate reported on its website that the Fed’s key benchmark borrowing rate is projected to rise by 0.75 percentage points in 2023, hitting a 17-year high of 5-5.25 percent from its current 4.25-4.5 percent level, according to the central bank’s median projection from December.

There won’t be enough gold to match cash overflow

Beck exhorted his viewers to be aware of what is happening so that they can make ample preparations before the U.S. hits rock bottom.

“When the [Fed] says, ‘We’re going to print money because we can’t let the stock market fail’ and all of the central banks in the West do the same thing – it’s just a matter of time of ‘When do we get to the bottom?'”

The host predicted this to happen within the year, with the mainstream media censoring the truth and even reporting the opposite.

“If there’s a collapse of the stock market, people start selling things. When the banks start to go under, they immediately have to start liquidating things and calling in loans. They have to also stop giving loans.”

According to Beck, the best solution he can suggest to Americans is gold and silver. However, he warned that there won’t be sufficient gold to match the cash overflow.

“Gold and silver are constitutionally dollars; that’s currency. The dollar that we have is a note, it says it’s worth this amount.”

“The problem is – there’s too much money and there’s not enough gold to reset the global markets to a gold standard, and to pay for what we have done all around the world.”

Watch the Jan. 11 episode of “The Glenn Beck Program” where Glenn Beck talks about Eastern nations dumping the petrodollar below.

This video is from the High Hopes channel on Brighteon.com.

More related stories:

Putin says BRICS countries are establishing new global reserve currency to replace U.S. dollar.

American dollar dominance FADES amid Saudi Arabian shift to China as its most “reliable partner.”

Saudi Arabia fortifies relations with Russia, thumbing its nose to the West.

Sources include:

Submit a correction >>

Tagged Under:

BRICS, Bubble, central banks, China, Collapse, commodities, currency crash, currency reset, debt collapse, dedollarization, dollar demise, economic collapse, economy, Fed, gold standard, market crash, money supply, petrodollar, petroyuan, reserve currency, risk, Russia, Saudi Arabia

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2018 PANIC.NEWS

All content posted on this site is protected under Free Speech. Panic.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. Panic.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.