U.S. agriculture faces “full-blown crisis” as trade war with China pummels farmers and consumers

05/02/2025 / By Willow Tohi

- Retaliatory tariffs from China and other nations have devastated export markets, causing price spikes, financial losses for farmers and domestic grocery cost surges. China’s cancellation of major orders (e.g., 12,000 tons of pork) exacerbates the strain.

- Key industries like soybeans (125% tariffs), pork (72%), dairy (50–54%) and lumber face severe declines, forcing farmers to divert goods to less profitable markets or store unsold inventory.

- Ports like Oakland report declining traffic, threatening regional economies, while exporters lay off workers and scramble to reroute shipments at unsustainable costs.

- Reduced export demand floods the U.S. market, lowering farm income but raising consumer prices for staples like cheese, apples and peanut butter.

- With China’s $35B agricultural market now inaccessible, stakeholders warn of irreversible damage without exemptions for agriculture in trade policies, emphasizing the risk to jobs, inflation and U.S. global competitiveness.

U.S. agriculture has entered a “full-blown crisis already,” according to industry leaders, as retaliatory tariffs from China and other nations devastate export markets, spur domestic price spikes and trigger massive financial losses for farmers. President Donald Trump’s trade policies have cut off access to China, America’s single largest agricultural buyer, with tariffs on soy, pork, dairy and other staples driving market chaos. Export cancellations, layoffs and plummeting prices are already rampant, while domestic groceries and dining bills surge. The U.S. Department of Agriculture (USDA) reports China’s cancellation of 12,000 tons of pork orders—its largest since 2020—as farmers brace for a crisis years in the making.

The tariff toll: Key sectors collapsing under trade retaliation

China’s retaliatory tariffs, ranging from 35% on lobster to a staggering 125% on soybeans, have triggered immediate fallout across U.S. agriculture. Soy exports to China—and related products like tofu and animal feed—have collapsed, while pork exports face tariffs as high as 72%, pushing domestic bacon and pork chop prices upward. Dairy industries, particularly in California, reel from 50% tariffs on almonds and 54% on wine, forcing farmers to divert products to less profitable markets.

“These tariffs aren’t just affecting one sector; they’re tearing through the entire agricultural supply chain,” said Peter Friedmann, executive director of the Agriculture Transportation Coalition (AgTC). “The loss of China’s volume is irreplaceable.” Agricultural exporters report storing unsold goods in bonded warehouses or diverting shipments at steep costs, while lumber companies slash purchases from independent truckers and sawmills to survive.

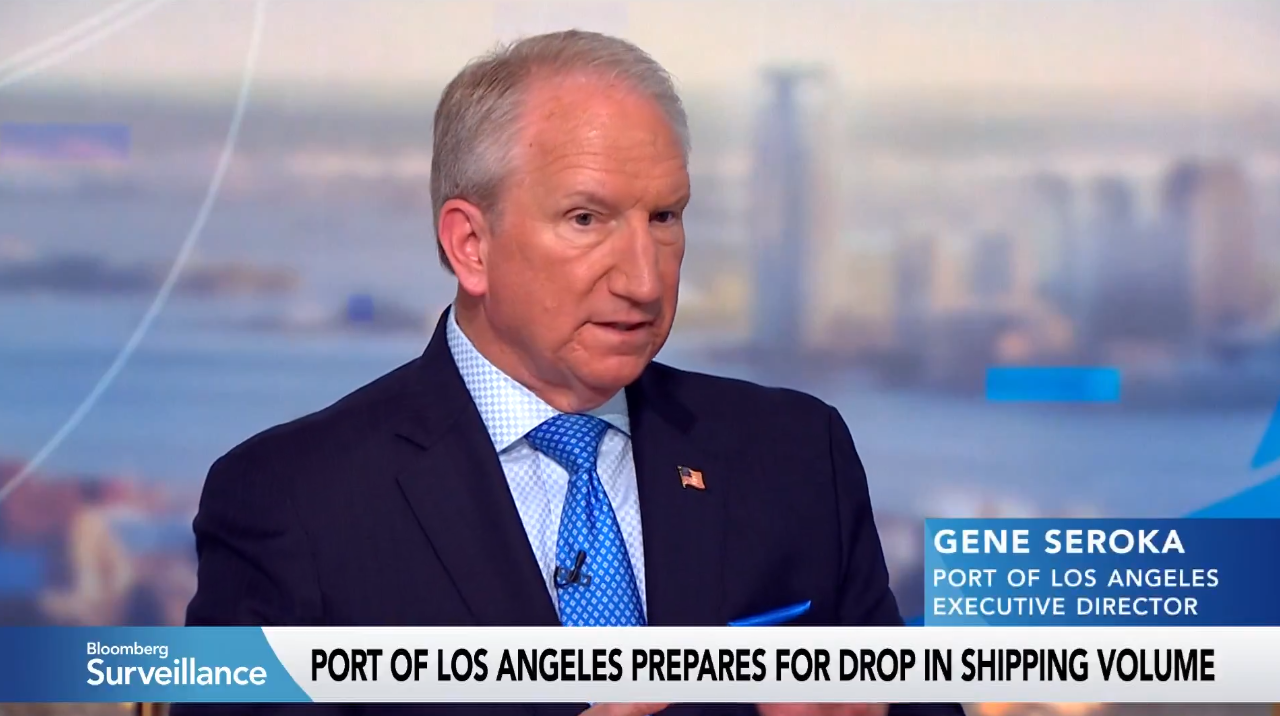

The crisis extends beyond farms to ports. The Port of Oakland, a critical gateway for refrigerated exports, warned that tariff-driven declines in vessel traffic threaten regional economies. “These policies risk destabilizing jobs and destabilizing our entire trade balance,” said Kristi McKenney, the port’s executive director.

Domestic consequences: Supermarkets and livelihoods in freefall

The ripple effects of export collapses are reverberating nationwide, with American consumers feeling the pinch at grocery stores and restaurants. Imported tariffs on Temu’s goods have spiked 145%, while domestic prices for staples like cheddar cheese, Gala apples and peanut butter have surged due to constrained supply chains.

“The math is simple: less export demand means more surplus in the U.S., which drives prices down for farmers but up for shoppers,” said Doug Beason, a California hay exporter who recently laid off 12 employees. His company, once a major supplier to Hong Kong, now scrambles to reroute shipments to Taiwan and Dubai at unsustainable costs.

Meanwhile, the SHIPS Act—slated to impose $1.5 million port fees on Chinese vessels come fall—threatens to exacerbate the crisis. Friedmann emphasized exemptions for containerized agriculture, which accounts for 55% of U.S. agricultural exports by value, are critical to prevent further turmoil.

Political and economic crossroads: Why this crisis matters now

China’s massive market, purchasing $35 billion annually in U.S. agricultural goods up until this year, was a cornerstone of rural economies. The current standoff mirrors past trade conflicts, but the stakes are higher amid record U.S. debt and inflation.

Rep. Lateefah Simon, D-Calif., warned, “These tariffs aren’t just bad trade policy—they’re jeopardizing millions of jobs.” Farmers and workers now face a unsustainable balancing act: endure prolonged losses or shift to lower-margin ventures.

The crisis underscores America’s reliance on global supply chains and the fragility of free trade assumptions. “No market can replace China’s scale,” said an almond grower in the AgTC report. “We’re looking at a generational reset for U.S. agriculture.”

A race against time to avert irreparable damage

With China’s tariffs unlikely to lift soon and bipartisan backlash mounting, the agriculture sector demands immediate action. “This isn’t just about farmers—it’s about everyone paying the grocery bill,” Friedmann stated.

As analysts warn of a potential economic “meltdown,” stakeholders urge policy shifts to exclude agriculture from punitive trade measures. Without resolution, farmers face ruin, grocery costs will soar further and the U.S. risks losing its position as a global agricultural leader.

As one hay exporter put it: “So much of our future lies in the hands of so few. Let’s hope they choose wisely.”

Sources for this article include:

Submit a correction >>

Tagged Under:

agriculture, Bubble, Collapse, debt collapse, dollar demise, economy, food collapse, food prices, Globalism, grocery, inflation, market crash, pensions, rationing, risk, supply chain

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2018 PANIC.NEWS

All content posted on this site is protected under Free Speech. Panic.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. Panic.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.